Sales and Service Tax

Sales and Service Tax

We are also licensed SST (Sales and Service Tax) agents and we have also prepared a set of FAQ on SST matters:

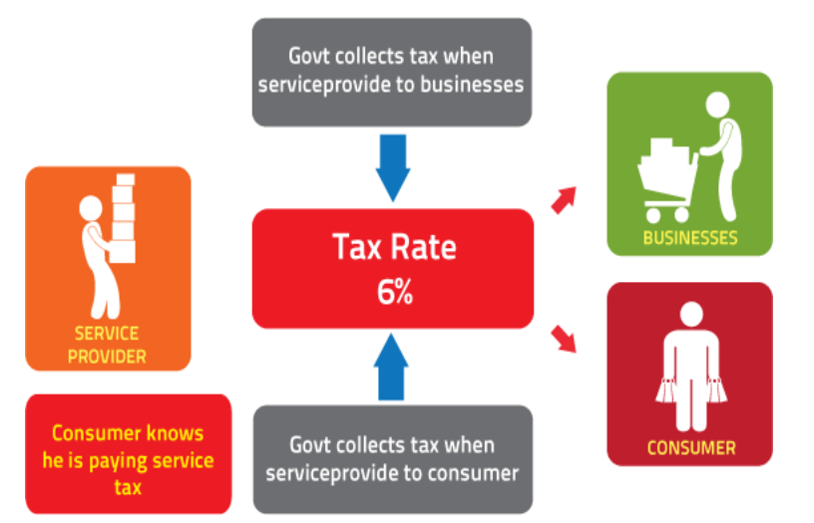

Sales and Service Tax, often abbreviated as SST, is a single stage taxation levied at manufacturer or consumer level (GST is levied at multiple stages from manufactures to consumers). Almost all businesses or companies are required to register for SST, those businesses with annual turnover more than specific threshold requires licensing for the taxes whereas those below the taxation threshold(will not be levied), will also require a certificate. As of this writing, the Sales Tax is at 5 – 10% whereas Service Tax is at 6%.

GST is reduced to 0% since June 1st 2018 whereas SST is set to implement on 1st September 2018 nationwide. There are 2 main categories fall under SST: the Sales Tax, and the Services Tax.

Sales is initially introduced in February 1972 and is a single stage consumption tax. The levy is charged and paid on the goods which are manufactured in Malaysia and the goods imported to Malaysia as well as the locally manufactured goods at the time the goods are sold or otherwise disposed of by the manufacturer.

Should I apply?

Manufacturers of taxable goods whose annual sales turnover exceed RM100,000 is required to be licensed under sales tax act. Those with annual sales turnover does not exceed RM100,000 are required to apply for a certificate of exemption from licensing. Generally, all goods, including motor vehicles, are subject to sales tax at the rate of 10% under the Sales Tax (Rates of Tax No.1) Order 2012 which came into operation on October 31, 2012.

Sales Tax: Threshold Level Taxable Services

| No Threshold |

|---|

|

What is Service Tax?

Service Tax is firstly introduced in March 1975 and a few constantly refinement since then. The current Service Tax rate is 6% and like Sales tax, it is also a single stage consumption tax.

Should I apply?

For all taxable services, charged and paid on specific services provided by a taxable person in Malaysia. Yes, for most of the businesses or companies, it is required. To find out if a service is affected, please to the table:

Professionally Recognized by: